As one of the world’s leading suppliers of new and used dairy machinery, Machinery World buy and sell plant and machinery worldwide to an ever increasing number of countries and continents.

From Iceland to New Zealand and every continent in between, the list of worldwide clients now numbers around 80 buying Filling machines, Packing machinery, Complete Plants, Evaporators & Spray Driers, Used Homogenisers, Ageing Vats, Batch Freezers, Batch Pasteurisers, Continuous Freezers, Fruit Feeders, Separators as well as Wrappers & Shrink Tunnels.

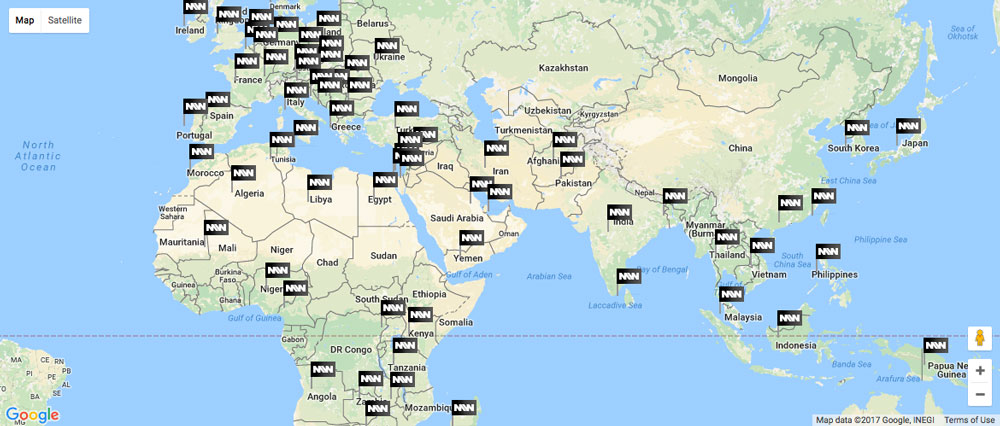

Our recently sold page shows some of the global locations our machinery has been delivered to.and our interactive map shows the spread of worldwide locations

As agents for new machinery from leading manufacturers, we also welcome part exchange, whether you require a single machine or an entire plant. Additionally, we are always interested in purchasing equipment ranging from complete manufacturing plants to individual machines and equipment.

When we buy machinery, we make prompt inspections, firm offers, and prompt payment, with global export facilities and skilled employees to perform removal and transport of machinery worldwide.

Instagram

Instagram YouTube

YouTube LinkedIn

LinkedIn